A Piece Of The Pie

March 11, 2020

From the restaurants & bars in every flourishing metropolis to the technology companies of the various Silicon Valleys, copycat businesses pop up in pattern-like fashion to seek a share of available profits. While competitive spaces can appear and sound theoretically perfect for bringing out the best innovations, I see that it is rarely necessary and beneficial for free markets to have more than a duopoly for any type of product. Imitation, the cause of overly competitive oligopolies, is an industry habit that needs to be corrected in order to best innovate in any sector.

But First... My Soapbox

WHO WANTS THEIR FOOD DELIVERED? I do! I do!

This aesthetically pleasing array of tablets is what I see across Bay Area restaurants and stands as a reminder of inexplicable waste. The incalculable amount of hours being dedicated to the customers who want locally housed “X” good without leaving “Y” location is remarkable. Uber Eats, Postmates, DoorDash, Grubhub, Seamless and the other 15 front-runners are all essentially building the same product with solutions that do not significantly differentiate from each other (with incredibly smart people powered by intense funding -- check out the funding rounds for DoorDash (1) and Postmates (2)). So much competition would inspire our inner capitalists to expect the most incredible services and innovations from these previously known power players, right? I'm talking about the future of condiment dispensing and Sippy cups that we were promised back in the '60s (I swear I'm going somewhere with this)!

The rationale behind competition breeding innovation seems accurate, but I’ve found the outcome in reality to be both boring and annoying for many industries.

The waste behind excessive competition for food delivery goes a lot further than you getting delivered the wrong order and throwing it immediately in the trash because "you're above McDonald's" now. For the sake of brevity in this discussion, I'll omit the more negligible aspects like total compute power and materials for tablets that run the different software. Starting with the restaurants themselves, the amount of time an employee/team must spend managing their flow of orders is not improved with distributed applications each running their own individual product flows (this point seems most obvious -- more complexity is not what Occam wanted). Focus your attention on the engineering hours used to build/support/advertise each app's non-novel software and the pile of waste will begin to appear more severe. I should add that engineers & data scientists do not want their hard work copied or killed in a short amount of time, but that's inherently more likely with more competition. How about each software having its own set of bugs? Lastly (and certainly not "leastly"), from the customer point of view, why should we need to know of 10+ redundant apps to effectively do the one task that we seek out to do?

Food Delivery apps stand as an archetype for many other industries too. I could draw a shocking amount of parallels with the ridiculous amount of video streaming services, micro mobility solutions (scooters, bikes, mopeds) and foam mattress companies. The scenario of “many players with little differentiation between products” is everywhere from social media to airlines. The winners and losers are often undefined and as I've described before, typically result in oligopolies. What I've personally noticed is the few advantages that do arise between these products are often negligible and (in my humble opinion) inflated by a means of clever marketing (take Molekule air purification as an example -- amazing marketing, debatably worse performance).

How did we get here?

Enter Peter Thiel’s Zero To One:

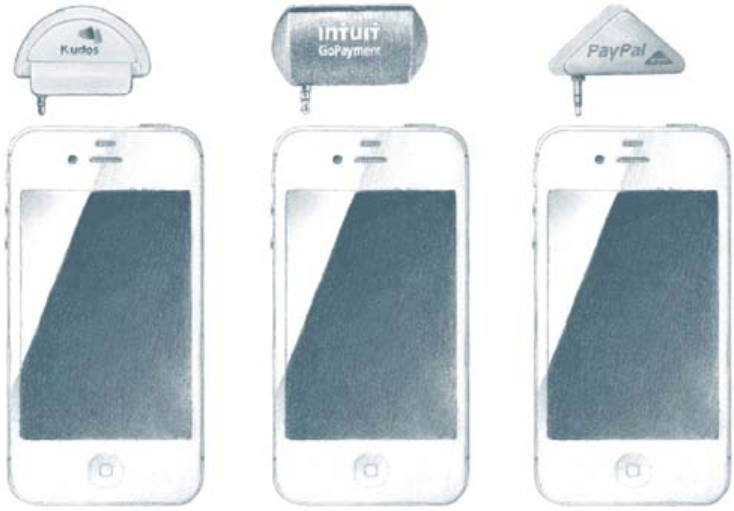

Throughout this prized Silicon Valley Bible (3), Thiel promotes the idea of avoiding competition at all costs and endorses the existence of monopolies to capitalize on human productivity and for better products. Eventually in their life cycles, as Thiel explains, competing companies start to focus on their competition's products and become less independently focused on new, valuable features. The following example described the process of Square, Intuit, PayPal and Netsecure essentially creating the same credit card readers for iPhones (doing nothing except imitating the first product and taking a different physical shape -- see photo below). The motive for this imitation is perfectly encapsulated by another Thiel quote:

Competition can make people hallucinate opportunities where none exist.

There is hard evidence why companies continue to imitate rather than innovate, but I have not completely condemned competition.

To Compete Or Not To Compete

We preach competition, internalize its necessity, and enact its commandments; and as a result, we trap ourselves within it - even though the more we compete the less we gain

What Thiel is saying about competition is clear cut: avoid it and ignore the dogmatic belief that it is necessary. Using the Zero To One philosophy, critical thinking about entering a competitive space is only necessary when a new product could (in theory) establish itself as a monopoly. Thiel plainly preaches that a monopoly should have technology that is 10x better than its closest substitute (easier said than done and necessarily so). Later in the book (published in '14), Thiel mentions how Tesla could be a perfect company to disrupt the oligopoly of the automotive industry. Undisputedly, Tesla has had far superior electric car technology compared to any of the other automotive giants for the last decade and therefore warrants the struggles of competition. It is here that one of the few exceptions to competition becomes clear!

Another possible avenue for justifiable competition occurs when a new product arises. Although rare, it is possible that an entirely novel and gigantic space opens up while a company works on it. Competing to seek out the low hanging fruit can manifest in faster moving enterprises to be the first one to "plant their flag" in wide-ranging turf wars. Uber vs Lyft was a useful duopoly as both companies were internationally pushing out unique features on top of the core offering that the world was entirely new to. Today, I would argue that there is solid reasoning for the two to merge (a strategy that I will cover later) because the available innovations have run dry. I would also throw space exploration, cloud computing, some ML/AI startups and plenty of bio-tech in this ring of novel businesses justifiably competing. As always, maybe I'm wrong? ENLIGHTEN ME.

My last example might be considered "anti-Thielian", however, I think it's worth mentioning as it is fairly unique. When trust in a mono, duo or even oligopoly begins to erode, startups focusing on a morally and benevolently motivated relationship with it's customers and providing the same product are valuable enough to build. I am probably considered crazy to suggest that a company should compete with Google's incredibly high-powered search, but I am doing just that by endorsing DuckDuckGo which focuses on privacy (indeed an area of ethical improvement for Google). DuckDuckGo will likely never seriously contend with Google for a majority stake in search queries, but it can be considered the right product fit for users who want a privacy motivated search engine. And for that, it is an endeavor worth undertaking by the DDG team because it is a product that does not exist.

As an aside, I’m open to, but skeptical of any argument for why the future of DoorDash is 10x better than Grubhub’s as I find the justification to be hidden in optimistic fantasies (drop me a line and change my mind). Even given the newly found COVID-19 innovation opportunities, I still suspect that none of these companies will establish a long-lasting edge for the next pandemic.

Merging The Equally Great

Merging forces is conveniently another piece of the Zero To One philosophy! Anecdotally, Thiel explained how a merger between X.com and PayPal was the best possible strategy given both companies were working tirelessly to create the same, useful product that did not fully exist yet.

It takes more than guts to call a truce, but setting egos aside can be beneficial for all (it paid nice dividends to the PayPal mafia). Why haven't any major food delivery companies merged recently? In my opinion, we have seen the well run dry for major innovations in this sector and no one is making allies.

The Necessary Truth

Like 99% of new product ideas, after giving it some critical thought, it needs to go back on the shelf (for further iteration) or be disposed of. Not because the idea couldn’t survive or be profitable, it is instead that the end product wouldn’t be the most productive use of resources. The depressing side of this is that we do not care enough as a species to focus on what is "best" versus what will amass the most dollars. A profitable business is, by our society's definition, successful. A modified definition of success is emerging, but its not as simplistic as the elder version.

Not only does a company need to support its own weight, it needs to have a place in the market and society. Pragmatic advancement of our species is more than paying people to push out the same lines of code with a different logo or to provide an airline service of equally shitty quality. Surely, the business powering a new product needs to be profitable, but the end products ought to progress their customer's lives in distinct and novel ways.

I highly suggest watching the following 5 minutes of this clip from Chamath Palihapitiya’s lecture at Stanford. Chamath echoes a similar mentality about building something that undeniably adds value to society versus the next money making venture.

So Why Are Companies Imitating Each Other?

Thiel offers a philosophical approach to answer this. He attributes this desire to the egotistical tendency to compete for beating your fellow human (and not for true progress). After reading his examples, I can't disagree with his assessment, but I do see some deeper layers depending on the circumstance.

It certainly plays a role in a given scenario if a company is large. In my opinion, the unnecessary expanding into competitive sectors would be the result of unethical greed to become "most meta".

This "unethical greed" is the monetary gains of the disruption of a market with a product that is merely a clone. For example, I am fairly positive that Google, Facebook or Apple could enter the food delivery space and would all likely be able to say that they have a positive number on their balance sheets. Why do these behemoths spare the saturated market? The real motivation for these companies to stay away from the extra money is philosophical & strategic. Simply, staying out of a specific sector can lead to more focus on their core products/offerings (areas that they innovate well in). On the other hand, if a small company approached a competitive space without real differentiation, I would attribute the senseless braveness to naiveté.

The state of being "most meta" as a business is worth talking about here too. Jaron Lanier writes extensively on this topic in part 5 of his book Who Owns The Future (4). Lanier asserts that large companies collecting data (denoted as "Siren Servers") create network effects that can control current & future customers. Network effects are not morally negative until they are used to "punish" people by inducing fear, risk and adding other costs that "capture" users with their platform. To make a clear example, let's suppose that there is a new cloud technology, product "Z", that is sweeping the world with its life-facilitating abilities. Companies that currently have gigantic ecosystems may feel the urge to recreate Z. For an existing powerhouse, some market share could be won by means of using its network effects on its existing customers. The ideal product for each customer becomes less clear cut. Lanier's argument is for companies to avoid malevolent use of their networks to become larger (and thus more "meta"), but instead allow smaller entities to focus on their specialized products.

Fully Endorse Monopolies?

I'd like to pen my answer to this confidently, but I am not as comfortably versed as I'd like to be of the arguments for monopolies (particularly of the libertarian kind). My main counterarguments against monopolies are the issues revolving around trust. For the sake of this argument, let us consider Facebook to be a monopoly. While Facebook may now have some incredible freedom to innovate and focus on their customers, they may also be taking advantage of what control they have of providing content for them to view. In this completely hypothetical dystopian case, the content in question could be biased political ads targeted at undecided voters. Without any other product to choose from, people might be stuck using Facebook despite its unethical violation of power. But this will never happen, right?

What Should I Do?

Hears cracking of egg shells beneath his feet...

My inner Thiel says avoid investing & working in saturated competitive spaces at all costs. I know the situation is more complex than what I have laid out in fewer than 8 paragraphs; however, the previous assessments of oligopolies & alternative business strategies make saturated competitive markets look foolish to take part in. With some non-zero probability of success, novel companies are far greater uses of resources to push humanity forward.

Sources

(1) - "Door Dash Crunchbase." , link.

(2) - "Postmates Crunchbase." , link.

(3) - Thiel, Peter. Zero To One. 2014.

(4) - Lanier, Jaron. Who Owns The Future. 2014.

Subscribe?

You can get an email sent to your Junk folder every time I write a new blog!